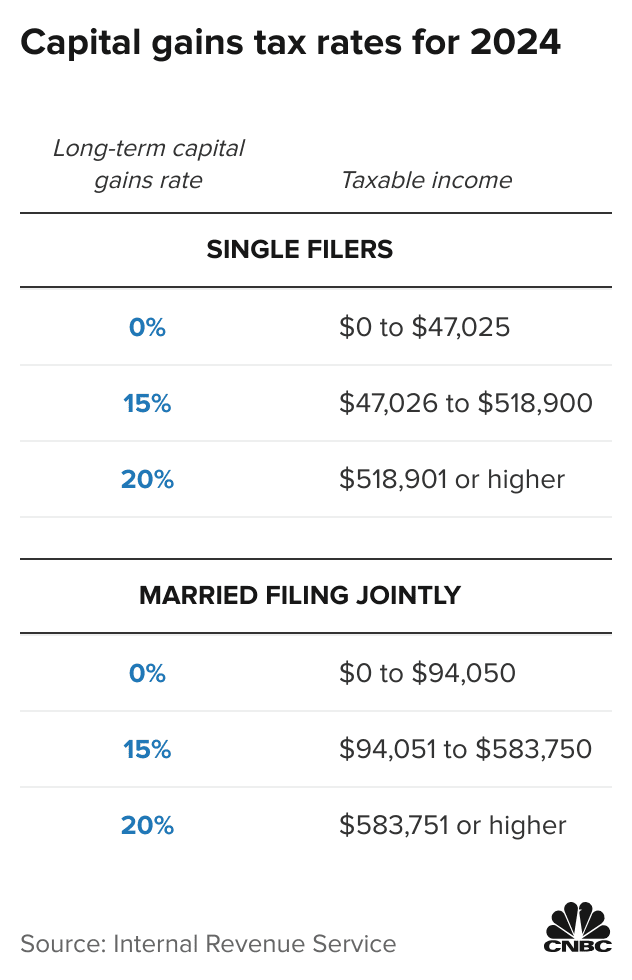

Tax Brackets 2024 Capital Gains Tax – There is a separate set of tax brackets and rates for long rates for ordinary income like wages. Will capital-gains tax rates increase in 2024? Congress hasn’t made changes to rates on . There is a separate set of tax brackets and rates for long-term capital gains and qualified dividends. Investors who have taxable accounts—as opposed to tax-favored retirement accounts such as .

Tax Brackets 2024 Capital Gains Tax

Source : www.cnbc.com

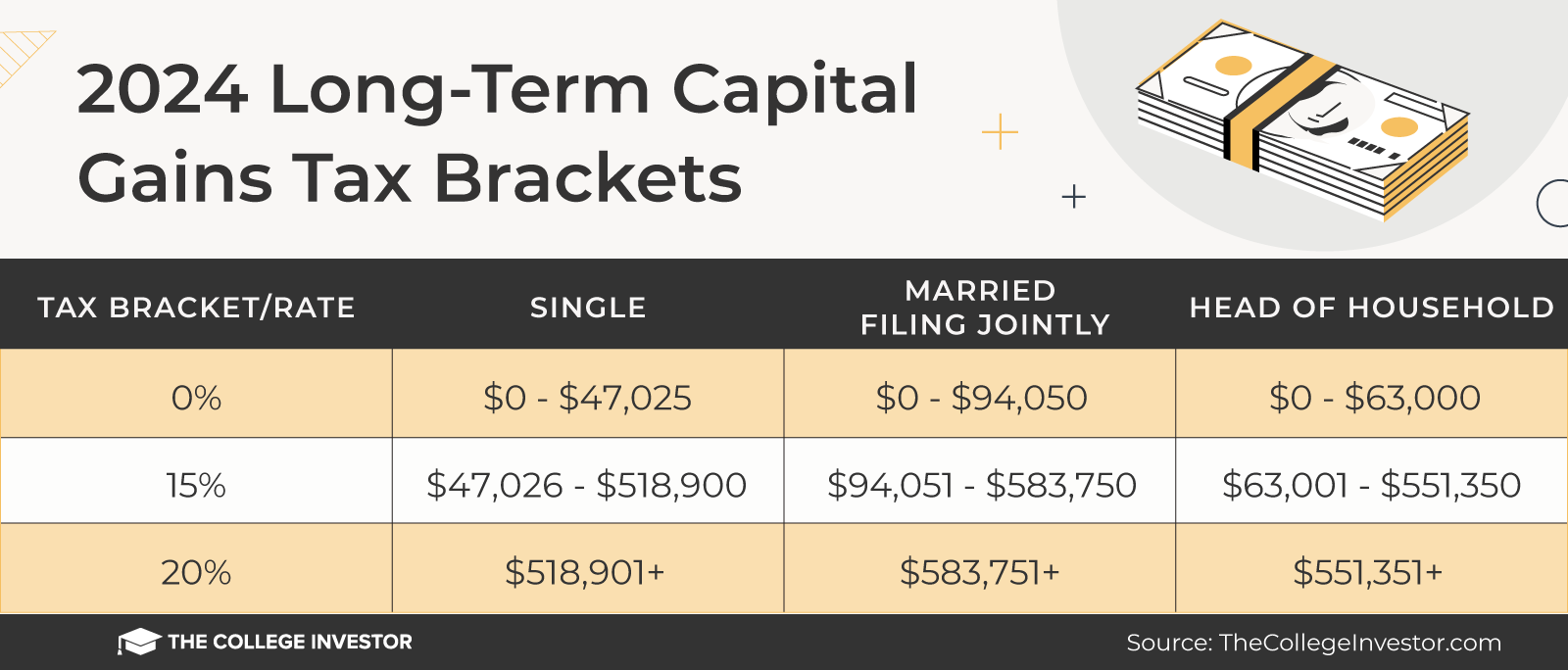

Capital Gains Tax Brackets For 2023 And 2024

Source : thecollegeinvestor.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Capital Gains Tax Brackets For 2023 And 2024

Source : thecollegeinvestor.com

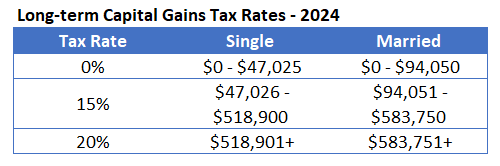

2023 2024 Tax Brackets, Standard Deduction, Capital Gains, etc.

Source : thefinancebuff.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

2024 Long Term Capital Gains Tax Rates | Darrow Wealth Management

Source : darrowwealthmanagement.com

Capital Gains Tax Brackets For 2023 And 2024

Source : thecollegeinvestor.com

What the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : www.wsj.com

Capital Gains Tax Brackets For 2023 And 2024

Source : thecollegeinvestor.com

Tax Brackets 2024 Capital Gains Tax How much you can make in 2024 and still pay 0% capital gains taxes: There is a separate set of tax brackets and rates for long-term capital gains and qualified dividends. SEC Approves Bitcoin ETFs for Everyday Investors Skydance Backers Explore All-Cash Deal to . Long-term capital gains tax is applied to investments that have been held for over a year before they were sold for a profit. Long-term capital gains are generally taxed at a lower rate. For the 2024 .